Table of Contents

Crypto Gdax

Understanding Crypto GDAX: A Look Back at a Key Player in Digital Assets

Have you ever wondered about the history of crypto trading platforms? Maybe you’ve heard the name “GDAX” pop up in discussions, especially if you’ve been in the crypto space for a while. Well, let’s talk about it. GDAX, which stood for Global Digital Asset Exchange, was a significant platform in the early days of widespread cryptocurrency trading. It was a big deal for many people buying and selling digital assets.

Initially launched by Coinbase back in 2015, GDAX wasn’t just another exchange. It was designed to cater to more experienced traders. Think of it this way: if Coinbase itself was like a user-friendly bank account for buying crypto, Crypto GDAX was more like a sophisticated brokerage platform. It offered advanced tools, real-time data, and features that active traders really needed. This distinction was important because it provided a more robust environment for serious crypto enthusiasts.

Next, GDAX became well-known for a few key reasons. For one, it provided lower trading fees compared to the simpler Coinbase platform at the time. This was a huge draw for those making frequent trades. Plus, it offered different ways to place orders, giving traders more control over their buying and selling strategies. It allowed direct trading of cryptocurrencies like Bitcoin and Ethereum against traditional currencies like the US Dollar, which was a big convenience.

After that, Crypto GDAX evolved. In 2018, it rebranded to “Coinbase Pro.” This change brought the professional trading platform more directly under the Coinbase brand. Then, even more recently, Coinbase Pro transitioned into “Coinbase Advanced Trade.” While the name changed over time, the core idea behind GDAX – providing a powerful, feature-rich environment for active crypto traders – continued. Understanding GDAX helps us appreciate the journey of crypto exchanges and why some platforms are built for different types of users. It was a crucial stepping stone in making crypto trading more accessible and professional.

Coinbase To Gdax

From Coinbase to GDAX: How the Trading Platform Evolved

You might already know Coinbase as one of the most popular places to buy and sell cryptocurrencies. It’s often the first stop for many who are new to digital assets because of its straightforward approach. But did you know that Coinbase also played a big role in creating a more advanced trading platform? Let’s trace that journey from Coinbase’s early days to the rise of GDAX.

In 2015, Coinbase took a significant step. They launched a dedicated crypto exchange initially called Coinbase Exchange. Think of the main Coinbase platform as your easy entry point, perfect for simply buying Bitcoin with a few clicks. But for those who wanted to trade more actively, with more control and better pricing, a different kind of platform was needed. That’s where Coinbase Exchange came in. It was built to offer a more robust environment for serious trading.

Next, this platform underwent a transformation. Coinbase Exchange was rebranded to GDAX, which stood for Global Digital Asset Exchange. This rebranding wasn’t just a name change; it solidified its identity as a professional-grade trading venue. GDAX was designed to provide deeper market insights and more sophisticated tools that casual Coinbase users didn’t necessarily need. This separation allowed Coinbase to cater to both beginners and experienced traders effectively.

After that, GDAX really started to gain traction, especially in the United States. It became incredibly popular because it was one of the few reliable exchanges where U.S. traders could directly trade Bitcoin for fiat currency, like the US Dollar. This was a huge advantage at the time. Many other platforms either didn’t support direct fiat trading or weren’t as trusted, making GDAX a go-to choice for Americans looking to move between traditional money and crypto efficiently. This ability to easily convert between fiat and crypto was a game-changer, fostering trust and making digital asset trading more accessible for a wider audience of serious traders.

Crypto GDAX Price

Understanding Crypto GDAX Price: How Digital Asset Values Were Set

When you’re dealing with cryptocurrencies, understanding how their value is determined is key. On platforms like GDAX (now Coinbase Advanced Trade), the Crypto GDAX price wasn’t just a number pulled out of thin air. Instead, it was a dynamic figure, constantly changing based on what was happening right there on the exchange. Think of it like an auction that never stops.

First, the most significant factor influencing Crypto GDAX price was the classic economic principle of supply and demand. If a lot of people wanted to buy Bitcoin on GDAX, and fewer people were willing to sell, the price would naturally go up. Conversely, if there were many sellers and not enough buyers, the price would tend to fall. This constant tug-of-war between buyers and sellers in real-time defined the GDAX market.

Next, GDAX displayed what’s called an “order book.” This was a live list of all the buy and sell orders that traders had placed. It showed you exactly how much crypto people were willing to buy at different prices, and how much they were willing to sell. By looking at this order book, traders could get a sense of where the Crypto GDAX price might move next. This transparency was a crucial feature for professional traders, as it helped them make informed decisions.

Then, there were external factors that often influenced the price. Major news events, regulatory announcements, or even big social media discussions could cause sudden shifts. For example, if a large company announced it was investing in Bitcoin, you’d often see a surge in buying activity, pushing prices higher. Likewise, negative news could cause a quick drop. This meant that while the order book showed you the immediate supply and demand on GDAX, the wider world always played a part in the overall market sentiment. This constant interplay of internal trading activity and external events made the Crypto GDAX price an exciting, albeit sometimes volatile, thing to watch.

Coinbase Wallet

Coinbase Wallet: Your Personal Crypto Vault

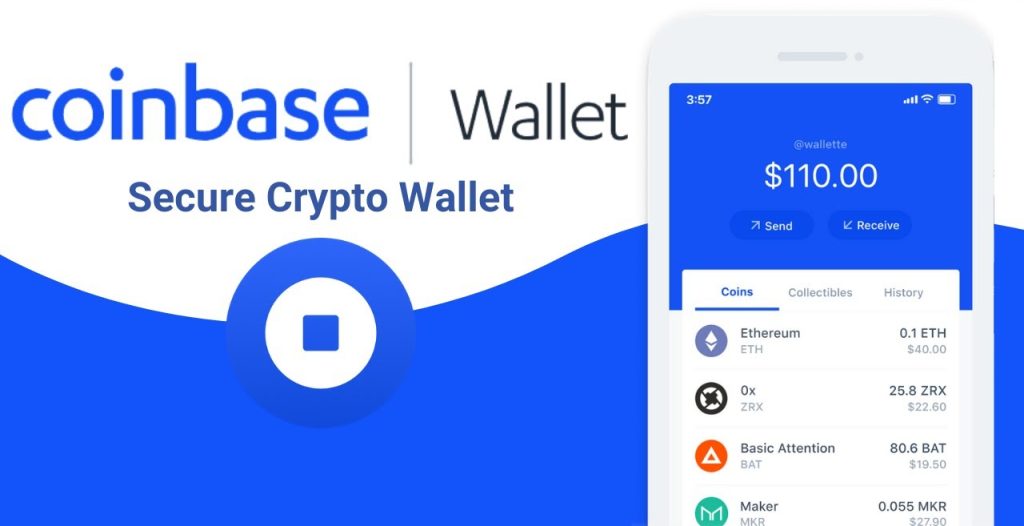

We’ve talked about Coinbase as an exchange where you buy and sell crypto, and GDAX (now Coinbase Advanced Trade) for more serious trading. Now, let’s look at something a bit different but equally important: Coinbase Wallet. It’s crucial to understand that Coinbase Wallet is not the same as your account on the main Coinbase exchange. Think of it as your very own, personal digital vault for your crypto.

First, imagine the main Coinbase exchange as a bank. When you buy crypto there, the “bank” (Coinbase) holds your digital assets for you. They manage the security, and you trust them with your funds. Coinbase Wallet, on the other hand, is like carrying your cash in your own physical wallet. You are in complete control. Nobody else, not even Coinbase, has access to the unique digital keys (called “private keys”) that control your cryptocurrencies.

Next, this control is called “self-custody.” It means you’re solely responsible for keeping your wallet secure. When you set up Coinbase Wallet, you’ll receive a special set of words, often 12 or 24, known as a recovery phrase (sometimes called a “seed phrase”). This phrase is the ultimate key to your wallet. If you lose your device or the app, this recovery phrase is the only way to get back your funds. It’s incredibly important to write it down and store it somewhere super safe and secret – never on your computer or phone where it could be hacked.

Then, beyond just holding your crypto, Coinbase Wallet lets you do much more. You can connect to a vast world of decentralized applications (or “dApps”) – things like games, lending platforms, and NFT marketplaces. It opens up the wider decentralized web (often called Web3). This is different from the main Coinbase exchange, which is primarily for buying, selling, and storing crypto in a more centralized way.

Finally, while Coinbase Wallet offers amazing freedom and control, it also comes with a big responsibility. Because you hold the keys, if you lose your recovery phrase or it falls into the wrong hands, there’s no “customer support” that can recover your funds for you. This highlights why managing your recovery phrase is so critical, and why understanding self-custody is vital for anyone in the crypto space.

Crypto GDAX Login

Crypto GDAX Login: Securing Your Access to Digital Assets (Then and Now)

We’ve explored GDAX as a powerful trading platform, how it evolved from Coinbase Exchange, understood how its prices were formed, and distinguished it from Coinbase Wallet. Now, let’s talk about something incredibly important that ties all of this together: the Crypto GDAX login process, and what it means for your security, both historically and in its current form as Coinbase Advanced Trade.

First, logging into GDAX, and later Coinbase Pro or Advanced Trade, always required careful attention to security. Just like with any financial account online, your username and password were the first line of defense. But beyond that, sophisticated platforms like GDAX emphasized additional layers of protection. This usually involved Two-Factor Authentication (2FA). This meant that after you entered your password, you’d also need a unique code, often from an app on your phone, to gain access. This extra step made it much harder for unauthorized individuals to get into your account, even if they somehow got your password.

Next, it’s crucial to remember that the security of your login is largely in your hands. Using strong, unique passwords for every online account is a must. Never reuse passwords, especially for anything related to your money or crypto. Furthermore, always be vigilant about phishing attempts. These are fake websites or emails designed to trick you into giving away your Crypto GDAX login details. Always double-check the website address to ensure it’s legitimate before entering any information.

After that, while GDAX, and its successors, provided robust security measures on their end – like keeping most funds in “cold storage” (offline) – your personal habits around login security are paramount. This is a key takeaway from our discussion about Coinbase Wallet too: whether it’s an exchange or your private wallet, your control over your access points is what truly protects your assets. Understanding these layers of protection is vital for anyone engaging with digital currencies.

Finally, navigating the world of crypto can be complex, and unfortunately, losses can occur due to various reasons, including security breaches or accidental mistakes. If you’ve experienced a loss, or simply want to ensure you’re doing everything possible to protect your digital assets, it’s always wise to seek expert guidance.

Learn more about our services to help safeguard your crypto and explore potential recovery solutions.