Crypto Trends 2025 - Key Predictions for 2025

Crypto Trends 2025

The cryptocurrency landscape is constantly evolving, with new trends shaping the future of digital finance. As we approach the end of 2025, the crypto market is poised for significant changes, driven by technological advancements, regulatory shifts, and growing mainstream adoption. This dynamic environment has caught the attention of investors, technologists, and policymakers alike, all eager to understand the direction of this revolutionary industry.

Looking ahead, several key areas are set to define the crypto space in 2025. Bitcoin’s price movements, Ethereum’s ongoing upgrades, and the emergence of DeFi 2.0 are at the forefront of discussions. Additionally, the expanding role of NFTs in the metaverse, changing regulatory frameworks, and innovative blockchain applications are likely to have a big impact on the industry. As the sector matures, addressing environmental concerns and exploring sustainable solutions will also be crucial to shaping the future of cryptocurrency and blockchain technology.

Bitcoin Price Projections for 2025

Halving Impact

The Bitcoin halving event in 2025 is set to have a significant impact on the cryptocurrency’s price dynamics. Occured on April 20, 2025, this event decreased the block reward to 3.125 BTC, influencing the supply and demand dynamics of the digital currency . The halving, which happens approximately every four years, has historically been followed by price surges, underscoring Bitcoin’s deflationary design .

The reduction in the rate of new coin creation tightens supply at a time when demand often remains steady or increases. This scarcity can enhance Bitcoin’s appeal as a digital store of value, drawing comparisons to precious metals like gold . The anticipation and speculation surrounding these events often fuel market activity and investor interest, further influencing price movements .

However, the impact of the halving on miners should not be overlooked. Without an increase in Bitcoin’s price, halvings represent an immediate drop in miner revenues and profitability . This could lead to a short-term decrease in the network’s hash rate as some miners may be forced to shut down . Historically, the hash rate tends to experience a temporary dip, followed by a rise in efficiency and overall hash rate in the long run .

Institutional Adoption

The approval of Spot Bitcoin ETFs by the SEC on January 10, 2024, marks a significant milestone for institutional adoption. These ETFs, including applications filed by financial giants like BlackRock, WisdomTree, and ARK, trade Bitcoin at its current, or spot, price . This approval has the potential to spark broader Bitcoin adoption by investment advisors, given the strong interest from retail investors .

The introduction of these ETFs has already had a noticeable impact on Bitcoin’s price. Following the SEC’s announcement, Bitcoin’s price skyrocketed to new all-time highs above $73,000 within two months . This surge demonstrated the significant influence that institutional involvement can have on the cryptocurrency market.

However, it’s important to note that institutional adoption remains limited. According to the NACUBO-Commonfund Study of Endowments for fiscal year 2023, only 23.2% of all endowments indicated that their investment policy statements allow for investment in digital assets . This suggests that there is still considerable room for growth in institutional adoption, which could be a key factor in Bitcoin price projections in 2025 and beyond.

Macroeconomic Factors

The macroeconomic landscape plays a crucial role in shaping Bitcoin price projections for 2025. Inflation rates and monetary policies are particularly influential factors. If inflation persists or rises in 2025, there’s a possibility that more people will seek to store their value in Bitcoin, potentially driving up its price .

However, the actions of central banks, especially the Federal Reserve, will be crucial. If they opt to adopt a contractionary monetary policy to fight inflation, resulting in higher interest rates, it could negatively affect Bitcoin’s price . Higher interest rates tend to be positive for the value of the US dollar and negative for higher-risk assets like Bitcoin.

The global economic conditions will also influence how different regions react to the 2025 Bitcoin halving. In countries with high inflation or falling local currency values, people might view the halving as positive news for Bitcoin, potentially using it as a store of value or a new medium of exchange . Conversely, in countries with strict cryptocurrency regulations or strong traditional banking systems, the excitement around the halving might be more subdued .

As we approach the end of 2025, these factors – the halving impact, institutional adoption, and macroeconomic conditions – will interplay to shape Bitcoin’s price trajectory. While historical patterns and current trends provide insights, the cryptocurrency market remains highly volatile and unpredictable, requiring careful consideration from investors and observers alike.

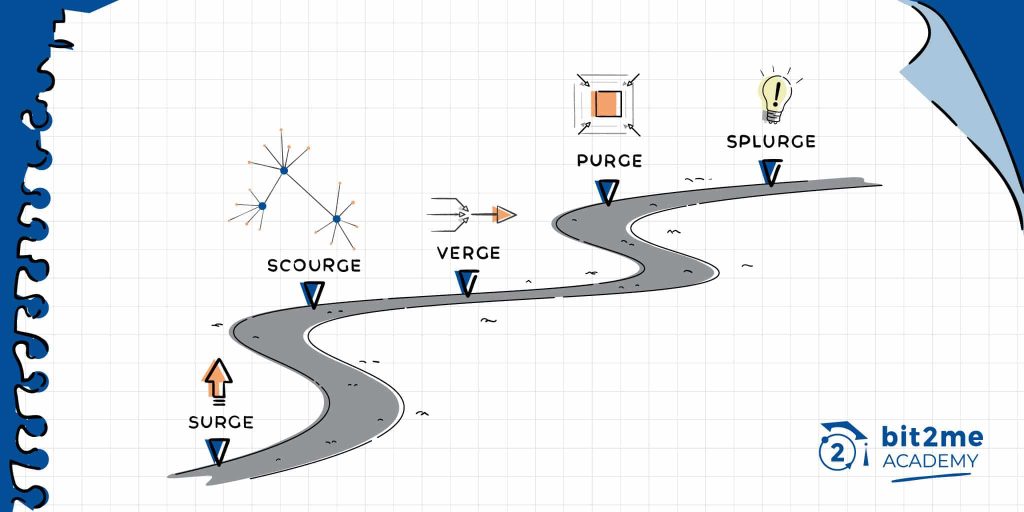

Ethereum’s Roadmap and Upgrades

Ethereum’s Roadmap and Upgrades

Dencun Upgrade

The Ethereum network has taken a significant step forward with the implementation of the Dencun upgrade. This upgrade introduces new data storage capacities aimed at reducing fee costs for Ethereum’s Layer-2 scaling solutions . The major feature of the Dencun upgrade is the creation of additional data storage capacity on the Ethereum network through the introduction of “blobs” . These blobs are large data packets temporarily stored on the consensus layer instead of the execution layer, leading to decreased fee costs for both the Ethereum network and the roll-ups themselves .

The impact of the Dencun upgrade has been immediate and substantial. Transaction costs have decreased significantly, with some Layer-2 solutions like Optimism and StarkNet recording fees below 1 cent . This reduction in transaction costs is expected to encourage more users to move onto roll-ups, thereby increasing the aggregate Ethereum-based transaction throughput .

Layer 2 Scaling

Layer 2 solutions have become increasingly important in addressing Ethereum’s scalability challenges. These solutions act as extensions built on top of the main Ethereum blockchain (Layer 1), handling transactions off the main chain and only interacting with it when necessary . This approach reduces the load on Ethereum, leading to faster transactions and lower fees .

The Total Value Locked (TVL) in Layer 2 solutions currently stands at an impressive 16 billion dollars, a figure expected to climb as more chains join and liquidity increases . There are two main types of Layer 2 solutions:

- Optimistic Rollups: These use economic incentives and game theory for validating transactions .

- Zero-Knowledge (zk) Rollups: These employ cryptographic proofs for security and privacy .

Both types of rollups consolidate multiple transactions into a single one that gets recorded on the main Ethereum blockchain . Optimistic Rollups focus on compatibility and ease, while zk-Rollups emphasize privacy and efficiency .

The Dencun upgrade has further enhanced the performance of Layer 2 solutions. For instance, Base, a Layer 2 network launched in mid-2023, has seen its operational costs reduced to less than 1 cent per transaction following the upgrade . Similarly, Blast, another Layer 2 solution, has also benefited from the upgrade, with gas fees reduced to less than 1 cent .

Staking Developments

Staking has become a crucial aspect of Ethereum’s ecosystem since its transition from Proof of Work (PoW) to Proof of Stake (PoS) . Staking involves locking up ETH to help secure the Ethereum network and earn rewards . Validators, who replace miners in this new system, play a vital role in processing transactions and maintaining network integrity .

To become a validator and stake ETH directly, a minimum deposit of 32 ETH is required . However, for those who don’t have 32 ETH or prefer not to run a validator node, there are alternative staking options:

- Staking as a service (SaaS): Providers like Rocket Pool and Lido manage the technical aspects of staking .

- Pooled staking: Multiple users combine their ETH to increase their chances of being selected as validators .

- Liquid staking: Platforms like Lido offer liquid staking tokens (LSTs) such as stETH, which represent staked ETH and can be traded or used in DeFi applications .

The Dencun upgrade has also introduced technical changes that impact stakers on Ethereum. These changes include perpetually valid signed exits for delegated staking participants, an increased attestation window for validators, and a fixed limit for new validators . These modifications aim to improve user experience and regulate the growth of the validator set .

As Ethereum continues to evolve, these upgrades and developments in Layer 2 scaling and staking are paving the way for a more efficient, scalable, and accessible network. The reduced transaction costs and improved performance are expected to drive further adoption and innovation within the Ethereum ecosystem.

DeFi 2.0 – The Next Wave

DeFi 2.0 – The Next Wave

New DeFi Primitives

The decentralized finance (DeFi) landscape is evolving rapidly, with innovative protocols emerging to unlock new forms of value. One such example is Nudge, a protocol launching on Ethereum that aims to extract economic value from users’ on-chain activities . Nudge introduces a novel concept called “Re: allocation Value,” which represents the hidden economic potential in users’ wallets .

This new DeFi primitive allows users to earn rewards by reallocating their assets between competing ecosystems. For instance, through “asset nudging,” users can be incentivized to move their stablecoins, memecoins, or governance tokens to different platforms . Similarly, “liquidity nudging” enables users to enhance returns by reallocating staked Ether (stETH) or liquidity to the highest bidder .

Nudge’s approach could serve as an alternative to existing on-chain incentive mechanisms like airdrops, which have faced challenges due to underperformance and disputes over payout criteria . The protocol is set to launch first on Ethereum, with plans to expand to other ecosystems such as Solana and Bitcoin L2s in the future .

Cross-chain Interoperability

Cross-chain interoperability has become a crucial aspect of DeFi 2.0, enabling seamless transactions and asset transfers across various blockchain networks. This technology allows users to access a wider range of DeFi services beyond the limitations of a single blockchain, opening up new possibilities in decentralized lending, trading, asset management, and yield farming .

The importance of cross-chain interoperability is evident in the significant Total Value Locked (TVL) in bridges, which exceeds USD 9.00 billion according to L2Beat . This demonstrates the growing adoption and impact of cross-chain solutions in the DeFi ecosystem.

Several protocols are at the forefront of enabling cross-chain interoperability:

- Axelar: Operating on a Hub and Spoke model, Axelar connects over 25 blockchain networks, allowing DeFi protocols to leverage liquidity across chains . This integration has attracted major players like JPMorgan’s Onyx Digital Assets for managing tokenized assets .

- Hyperlane: Focusing on modularity and permissionless interoperability, Hyperlane allows direct communication between decentralized applications (dApps) without relying on a central hub . Their integration with Celestia enables cross-chain transfers of TIA between rollups .

- Chainlink’s CCIP: The Cross-Chain Interoperability Protocol enhances the DeFi ecosystem by enabling cross-chain liquidity pools and interoperable DeFi protocols . This improves liquidity, reduces slippage, and offers better prices for traders .

Real-world Asset Tokenization

Real-world asset (RWA) tokenization is gaining traction in the DeFi space, bridging the gap between traditional finance and the crypto market. This process involves converting tangible assets like cash, equity, bonds, loans, real estate, commodities, or fine art into digital tokens on a blockchain .

The entry of major financial institutions into the RWA tokenization space has further validated its potential. BlackRock, the world’s largest asset manager, launched BUIDL, a tokenized fund on the Ethereum network backed by a mix of cash, U.S. Treasury bills, and repurchase agreements . Similarly, Franklin Templeton introduced the Franklin OnChain U.S. Government Money Fund (FOBXX), the first US-registered mutual fund to use blockchain for processing transactions and recording share ownership .

Several crypto projects are driving the tokenization of RWAs:

- Realio: An interoperable Layer 1 network supporting real-world asset management with open-source and permissionless infrastructure .

- Ondo Finance: One of the largest players in the USD 1.20 billion tokenized treasury market, focusing on bringing institutional-grade money into the crypto space via tokenizing T-Bills .

- Swarm Markets: A decentralized trading platform allowing institutional investors to trade and stake tokens based on RWAs such as commodities or financial securities .

The tokenization of real-world assets offers several benefits, including unlocking liquidity for previously illiquid assets, enabling portfolio diversification, driving global accessibility of the crypto market, boosting DeFi innovation, and providing a secure platform for investors . As the crypto market continues to mature, RWA tokenization is set to play a pivotal role in mainstream adoption and investor empowerment .

NFTs and the Metaverse

NFTs and the Metaverse

The convergence of Non-Fungible Tokens (NFTs) and the metaverse is reshaping digital interactions and ownership. NFTs, unique digital assets verified through blockchain technology, serve as a cornerstone in the metaverse economy. In 2021, NFT sales skyrocketed to USD 25.00 billion, a dramatic increase from USD 94.90 million in 2020, indicating rapid growth in this sector .

Gaming and NFTs

The gaming industry has embraced NFTs, creating new paradigms for player engagement and value creation. Games like Axie Infinity allow players to breed and collect NFTs of digital pets called Axies . This integration has given rise to the “play to earn” (P2E) model, where gamers receive financial incentives for their time and effort within games. P2E contrasts with traditional gaming by allowing players to earn cryptocurrencies that have real-world value .

NFTs in gaming offer several advantages:

- Verifiable ownership of in-game assets

- Ability to trade assets on secondary marketplaces

- Potential for cross-platform use of digital assets

The P2E model has transformed gaming economics, allowing players to monetize their skills and time investment. For instance, when a gamer creates an NFT character that others use to earn cryptocurrencies, the creator receives a portion of those earnings .

Brand Engagement

Brands across various industries are exploring NFTs to enhance customer engagement and strengthen their market presence. Luxury brands are minting NFTs of iconic designs, photos, and accessories, while beverage companies are building virtual breweries in the metaverse . These initiatives, while not immediately yielding significant financial gains, have the potential to:

- Strengthen brand identity

- Increase consumer engagement

- Drive deeper consumer insights

Some brands are providing “member” benefits to NFT holders, offering preferred access to future products and experiences . This strategy creates a sense of exclusivity and fosters brand loyalty in the digital realm.

Virtual Real Estate

The concept of virtual real estate has gained significant traction in the metaverse. Platforms like The Sandbox and Decentraland allow users to create, develop, host, and sell virtual properties, with each land parcel represented as an NFT . This digital real estate market has seen remarkable growth, with some notable transactions:

- The most expensive metaverse land sale recorded was USD 5.00 million in TCG World .

- A property adjacent to Snoop Dogg’s virtual estate in The Sandbox sold for USD 450000.00 .

- Republic Realm invested USD 4.30 million to develop 100 islands, known as Fantasy Islands .

Virtual real estate in the metaverse offers various opportunities:

- Hosting virtual offices with complete operational capabilities

- Setting up retail storefronts in high-traffic areas

- Creating exhibition spaces and performance venues for artists

- Developing educational and training environments

The metaverse real estate market involves developers, investors, and end-users engaging through cryptocurrencies and blockchain technology. This digital frontier presents new avenues for investment, branding, and innovative business models in a rapidly evolving digital landscape.

As the metaverse continues to develop, NFTs will likely play an increasingly crucial role in authenticating ownership, facilitating transactions, and creating value in virtual environments. However, challenges such as transaction complexity and high fees remain barriers to widespread adoption . Despite these hurdles, the integration of NFTs in the metaverse presents exciting possibilities for digital ownership, creativity, and economic activity in the virtual realm.

Crypto Regulatory Landscape

Crypto Regulatory Landscape

US Crypto Regulations

The United States regulatory landscape for cryptocurrencies remains complex and fragmented. Despite the [SEC’s approval of spot Bitcoin ETFs](https://icryptoai.com/2024/05/28/top-crypto-innovations-to-watch-in-2024/), which marks a significant development for the industry, regulatory uncertainty persists due to structural factors in the US system . The SEC continues to aggressively pursue perceived violations of securities laws across cryptoasset markets, while jurisdictional entanglement between the SEC, Commodities Futures Trading Commission (CFTC), and other federal regulators creates a complex environment for market participants .

Key banking regulators, such as the Office of the Comptroller of the Currency (OCC) and the Federal Reserve, remain cautious about allowing crypto to integrate closely with the banking system . The SEC has brought dozens of enforcement actions against actors in the crypto space, leading its chair to conclude the industry is “rife with abuse” .

In 2023, the SEC issued a release proposing rules and amendments to address conflicts of interest associated with the use of predictive data analytics and AI by investment advisors and broker-dealers . The agency’s approach of “regulation by enforcement” continues to be prevalent, especially in cases involving unregistered offerings, NFTs, and unregistered exchanges .

Global Regulatory Trends

Globally, there has been significant progress in digital asset regulation throughout 2023, although much work remains to be done . The development of regulatory and legal frameworks has been instrumental in restoring trust in digital assets . Countries like France, the UAE, and Hong Kong are emerging as beacons of regulatory clarity in 2024 .

In Europe, the UK and other jurisdictions are focusing on building specific rules for the crypto space, making it easier for businesses to operate by reducing guesswork . The EU’s Markets in Crypto-Assets Regulation (MiCAR) is set to influence the global regulatory landscape .

Several US states have also taken steps to regulate the crypto industry. For instance:

- Alabama established the Alabama Blockchain Study Commission .

- Arkansas enacted laws to regulate digital asset mining businesses and prohibit foreign party-controlled ownership .

- Georgia prohibited governmental agencies from using central bank digital currency as payment .

- Louisiana enacted laws prohibiting certain government regulations of digital assets and providing for the regulation and licensure of virtual currency businesses .

Impact on Crypto Adoption

The evolving regulatory landscape has significant implications for crypto adoption. Clear regulatory guidance is seen as the cornerstone of renewed stability in the crypto ecosystem . By enforcing anti-fraud and securities regulations, the SEC aims to prevent fraud, reduce market manipulation, and force more disclosure from cryptocurrency holders and exchanges .

Increased regulatory oversight could help legitimize cryptocurrency enterprises and attract more traditional investors and institutions, potentially leading to broader adoption . By creating a level playing field, SEC enforcement could encourage innovation and competition, which are essential for the crypto sector’s long-term sustainability and growth .

However, the lack of cohesive and specific regulations in the US, compared to the more focused approach in Europe and other jurisdictions, presents challenges for businesses operating in multiple states . The absence of federal regulation has led to state regulators filling the void, with some states becoming more sophisticated in their approach to crypto regulation .

As the regulatory landscape continues to evolve, striking a balance between innovation and investor protection remains crucial for the healthy growth of the cryptocurrency market .